By now, you’ve probably noticed that every purchase you make these days comes with a pitch for an upgrade or some add-on that the seller swears that you need but that makes you wonder if it’s at all legit. Whether it’s the rust-proofing on a new car (H/T Seinfeld) or an extended tech-support subscription, nothing is just a product anymore; there are always extras and they always have fees… and publishers know this so they perpetuate the highly profitable model when it comes to college textbooks.

With academic publishing being a for-profit endeavor and textbook publishers being clever producers well versed in creating demand, you need to be a smart shopper and just as savvy when it comes to buying textbooks as you are when it comes to buying the latest smartphone. What used to be a simple choice between expensive new books and cheaper used books now involves factoring in whether it’s better to buy or rent textbooks, whether eBooks are worth a try, whether or not you can get by sharing textbooks (or not using the textbook at all), and of course, whether or not you need the mysterious access code.

So what’s the deal with textbook access codes and do you really need them? And if you really do need an access code, do you absolutely have to buy a brand-new book so as to guarantee that the code is still valid and you can get the material that is beyond the book?

In a nutshell: access codes are complicated and whether you need them or not is really on a case-by-case basis. So knowing that you need to evaluate your own particular needs (with regard to the text, the syllabus, your professor, etc.), there are still some general rules that will help you decide whether or not you need to pay extra to get a book that has a brand-new active access code.

First, Check Yourself and Ask “Do I Even Need the Textbook with the Access Code?”

- Look at your syllabus. If on your syllabus you see no indication of using the supplement or online components such as readings and quizzes or problem sets, you might not need that pricey little code and you might be able to get a much cheaper used book without the extras. Note: If you need to complete graded assignments online, you’re going to need a unique access code (more on those in a minute).

- Talk with your professor. Even if you don’t see supplemental stuff on the syllabus, talk with your professor and make sure that you will not need the online access components and that the in-textbook readings themselves will suffice. This is also a great way to meet your prof and indicate that you are on board and into doing all you need to do for the course.

If You Really Do Need a Textbook with an Access Code…

So you’ve checked and asked, and yeah, you do need the access code. What now? Are you condemned to buying a brand-new copy of the book and paying that crazy price that includes the access code? Maybe but maybe not.

It used to be that the answer was always yes and there was no way around that. If you needed access codes for textbooks, you had to buy what is called the bundle or the package. This included a new print textbook and the supplement that could only be used once. And publishers loved this monster that they had created because it meant that they eliminated the used textbook market and the textbook rentals options for entire books and even courses. Mo’ money for them, mo’ problems for students.

In short, it got messy. A lot of third-party sellers took used editions where the access codes were no longer valid and they sold those books not caring whether or not students needed the codes. Some sketchy third-party sellers even started sites where they promised that students could download textbook access codes (for free or at serious discounts). But those downloads were useless and they contained things like malware or they required that the user enter private data, which compromised the user’s identity, and scammers profited. Beware offers on YouTube and eBay for access codes!

Things are a little better now. Students voted with their wallets by simply not buying new books with expensive access codes or buying used copies and doing without the codes. And because money talks, publishers realized that they had alienated a lot of college students by creating these massively expensive bundles of textbooks plus access codes. Publishers got wise and came up with a compromise, one that we recommend for you if you really do need textbook access codes: Legal and legitimate downloads of just the access code and supplemental material directly (and safely and securely) from the publisher thus freeing you to buy or rent a money-saving used textbook. This sort of a la carte option isn’t available for all textbooks with supplements but leading publishers like Pearson, WebAsssign, McGraw-Hill, and MyMathLab are making it increasingly so.

Bottom line: Only get the access code if you absolutely must have it and you have verified that on your syllabus and from your professor. If you do have to purchase a textbook access code, do not immediately buy the new bundle but instead consider buying just the code from the publisher or portal as well as a copy of the used textbook or even renting it.

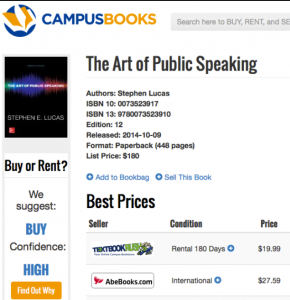

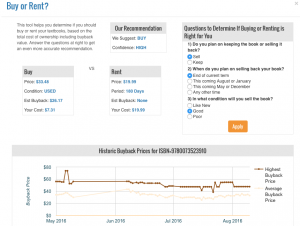

It’s so easy and so helpful and it takes the guesswork out of getting textbooks without getting ripped off. Just do what you already do: go to

It’s so easy and so helpful and it takes the guesswork out of getting textbooks without getting ripped off. Just do what you already do: go to

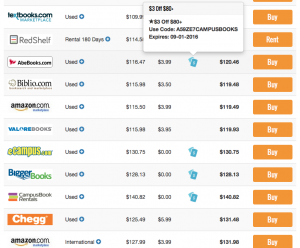

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using