If you’re like most graduates, your cap and gown came with a ton of gift money from family and friends. Is all that cash burning a hole in your wallet? Before you dump your new nest egg on the latest smartphone, think about your future. If your new degree didn’t come with financial planning classes, you can still start your economic future off right. Use that money wisely with these four smart tips.

Continue reading

Search Results for: money

How to Make Money While Still in College

College costs go well beyond the price of tuition, so covering expenses calls for creative solutions to make money. In addition to the savings, grants, scholarships, and loans used to pay for school, part-time income can also provide a vital financial boost while you are earning your degree.

Sometimes, work commitments can interfere with your first priority of getting an education. The key to lining your pockets without sacrificing good grades is finding balance and scheduling your work outside study hours. Easier said than done? Fortunately, there are lots of ways to make cash while you’re still in school, without failing in the classroom.

Conventional College Cash

Work/Study – These structured programs are part of a complete financial aid package. Students fortunate enough to land these positions may be put to work in administration offices, academic departments, food service facilities, and other convenient campus locations. To be considered, apply through regular financial aid channels.

Hospitality Jobs – Hotels, resorts, restaurants, and other food and beverage outlets require staff. And hospitality is a 24-hour business, so the hours present flexible scheduling options for college students. Not only that, but many of these service positions include tips, so the pay is above average. Front desk positions, kitchen jobs, wait staff, and bartending spots are all fair game during school. And if you play your cards right, a part-time hospitality job could grow into an internship or full-time management-level work.

Childcare and House/Pet-Sitting –

Side sitting jobs can furnish a steady source of income. If you don’t know a lot of people in your college town, your professors and school advisors may be a good starting point for finding this type of work. Once established with a satisfied customer or two, word of mouth will keep clients coming in.

A Little Less Conventional

If you are a budding entrepreneur or simply march to the beat of your own drum, consider one of these ideas.

Resale Business – From textbooks to gently used electronics, second-hand sales can help you earn money during school. A flexible, self-inspired resale business can be run from home during hours you choose. And you’ll learn lessons about marketing, accounting, customer service, and business management.

Blood/Plasma – This isn’t for the squeamish, but regular plasma donations can add up to a sizable part-time income.

Driving Jobs – Driving for Uber or Lyft can generate part-time income, but your age or level of experience might get in your way. If you’re not yet eligible to drive for one of these high-profile companies, look at food delivery opportunities instead. Or start your own service hauling goods, turning your car or minivan into a money-maker.

Reviews and Feedback – Information is valuable, so your opinions and feedback can bring in cash. Secret shoppers, for instance, are paid to interact with staff and rate their performance. Audiences also earn money by providing viewer feedback about commercials, TV programming, and movies.

When your college cash flow stalls and you need a financial boost, don’t despair. There are plenty of ways to earn extra money, from traditional jobs like waiting tables to new-fashioned jobs like second-hand internet sales.

Textbook Buyback: Getting the Most Money (Part 2)

In Textbook Buyback: Getting the Most Money (Part 1), we covered basics such as comparison shopping for the highest buyback offers, reading the fine print, following textbook buyback rules and best practices, and avoiding the campus bookstore.

Now in Part 2, we’ll go deeper and show you how putting in a little more work can basically lead to incredibly cheap textbooks or books that actually make you money to buy, use, and sell. Think of it like the stock market and investing; it’s all about timing and buying low and selling high.

Bigger Bucks at Buyback: Here’s How It Works

You don’t have to be an Econ. major to understand supply and demand. Bottom line: the more available something is, the less valuable it is and thus, the cheaper it is to buy; the more scarce a resource, the more expensive. What happens at textbook buyback? Students form a long line to turn over the same books as everybody else in line and many students in many lines at many colleges. ALL AT THE SAME TIME. The market is flooded, which is why that clerk at the bookstore tells you that your book gets you $3 back or the bookstore isn’t even buying it.

A quick note here: there’s other stuff at work such as new editions coming out that replace existing editions, professors not knowing which books they will use the next semester thus leaving the bookstore not knowing which books to stock, etc. But let’s stick to what we know, namely that in December and May right after finals, students sell their books back and that creates a surplus, which devalues the textbooks.

And Here’s What You Can Do

What can you do about this? Well, you can’t control what other people do or what bookstores pay or when semesters end, but with a little knowledge, foresight, and patience, you can hang onto your books a little longer and likely sell them for more cash back when the market isn’t saturated with too many copies.

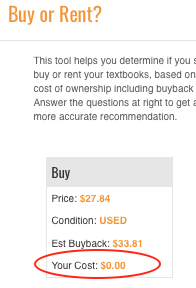

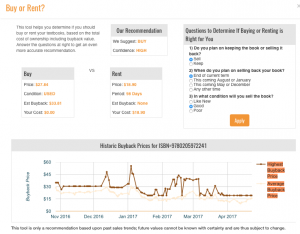

Step 1: Know when to buy textbooks and know when to rent textbooks. This was kind of a crapshoot until we came up with the CampusBooks.com Buy Vs. Rent SuperBot, which uses historical and predictive data to give you the total cost of ownership for any textbook.  What’s total cost of ownership? That’s what it costs you to get the book and use it, whether that’s buying it and selling it back or renting it and returning it. Sometimes it’s cheaper to rent, sometimes it’s cheaper to buy and sell back, and now you can know and make smart money decisions rather than guess and take a costly hit.

What’s total cost of ownership? That’s what it costs you to get the book and use it, whether that’s buying it and selling it back or renting it and returning it. Sometimes it’s cheaper to rent, sometimes it’s cheaper to buy and sell back, and now you can know and make smart money decisions rather than guess and take a costly hit.

Step 2: For books you rented, just get them back on time and in good condition. For books you bought and do not want to keep, sell them when they are the most in demand and most valuable, namely in late August and early January. Straight up: that is when buyback prices are the highest because the books are in the greatest demand (because it’s back to school time and buyers need your books so they can sell them to other students). Get it? Sell your textbooks when everyone else is buying them and you’ll get top dollar, sometimes enough so that the total cost of ownership was nothing (free textbooks!) or to make a little money.

Textbook Buyback: Getting the Most Money (Part 1)

Just a few semesters ago, it felt like it was a given that selling back textbooks was a pretty awful process. We could describe buyback it as a hassle that almost always involved waiting in lines only to experience disappointment over feeling utterly ripped off. But things have changed — and for the better.

Not only does textbook buyback not have to be a time-waster that culminates in rage, it can actually be fast, easy, and lucrative.

Here, in Part 1 of our Spring Textbook Buyback series, we’ll touch on the rules and basics of buyback. This info will help you get organized and it will put you in great shape when it comes to actually selling your books back in the coming weeks. In our next installment, we’ll go deeper and we’ll cover tips and tricks that will get you the most money back — sometimes so much that you actually will have made money buying, owning, and selling back a textbook!

Buyback Rules, Basics, and Reminders

- Avoid the campus bookstore. Sure, you can try to sell your books back at the college bookstore, but bookstores are notorious for 1) making students stand in line for hours, 2) declining to buy a lot of titles, 3) offering about $5 for that book that cost $200 at the beginning of the semester.

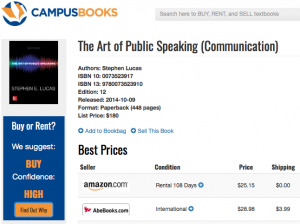

- Shop around. In owning textbooks, you possess a valuable commodity and your have options. Use the CampusBooks.com SELL Price Comparison Tool to see ALL of the offers available and to pick the best deal.

- Don’t assume that you can’t sell certain books. Even if you highlighted text or used the access card, your textbooks — even a little used and/or without supplements — may still have buyback value, which brings us to…

- Be honest. Don’t tell a buyer that your textbook is in good condition when it’s warped from a beer spill. Don’t say that the book is complete when you lost the DVD. It’s better to get a little less than to get nothing at all.

- Read the fine print. Some buyers have a minimum for payout, some offer credit rather than cash. Others buyers won’t accept books shipped without using official pre-paid labels or they won’t take international editions. Know the deal before you take it. #LifeLessons

- Follow instructions and follow through. Remember that thing about textbooks being a valuable commodity? That. When it comes to buyback, you’re dealing with for-profit businesses, not your softy English professor who always gives extensions and grades on a curve. So, if a buyer tells you that a buyback quote is good through a certain date and that you need to ship the book via UPS and pack it with the quote printed out and in the envelope, you need to do exactly that.

Next Steps

- Keep this list handy for when you’re ready to sell.

- If there are textbooks that you’re already finished with and don’t need for finals or term-papers, start putting them into Keep/Sell piles.

- Check your shelves for any books you’ve held onto in the past but now might be ready to sell and add those to your Sell pile.

- Stay tuned for Part 2 where we’ll talk about tools that can make selling back books easier and faster and we’ll also talk about timing and how holding onto your book a little longer could mean getting a lot more money later.

The Little Cash Icon That Saves You Big Money on Textbooks

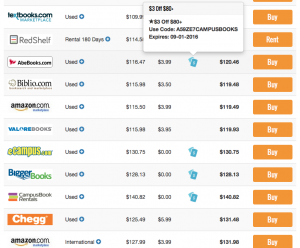

By now, you already know that paying list price for books or buying them on campus is crazy and that you can save up to 90% on textbooks using CampusBooks.com. But here’s a little hint to help you save more: When you search for your books and run your textbook price comparison, look for the little blue cash icon in the Coupons column.

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using our app) and you’ll see exactly how much more you can save with textbook coupons.

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using our app) and you’ll see exactly how much more you can save with textbook coupons.

All year we’ve got money-saving extras like free shipping and bonus buyback cash so that you get the most for your textbook bucks. But just in time for back-to-school 2016, we’ve loaded up CampusBooks.com with more (and better) textbook coupons than we’ve ever had before.

These coupons cover buying textbooks and renting textbooks and many of our coupons are CampusBooks exclusives, which means that you can’t find these add-on savings anywhere else. Seriously, an extra 10 seconds of your time could save you an extra 10% (or more) on your textbooks this fall. Save on, smart shoppers, save on.

Handling Money: Avoiding Overdraft Fees

Whether school is in session or you’re on break, it’s difficult to find time to monitor your bank account. However, if you don’t balance your checkbook or check your balance online, you might incur overdraft fees by spending more money than you have in your account. Try these strategies to avoid financial penalties and other complications associated with overdrafts.

Set an Online Alert

Modern banks have adapted to technology just like businesses in many other industries. If you have access to online banking, you can probably set account alerts. You’ll give your bank a minimum balance, such as $50, and you’ll receive an email or text message if your balance dips below that threshold.

Account alerts can stop you from spending money you don’t have. As soon as you receive a notification, you can either put the kibosh on purchases or transfer money from another source into your bank account. You’ll avoid overdraft fees and perhaps develop more responsible spending habits.

Check Your Bank Account Once Per Day

If you don’t want to balance your checkbook manually, set up online access. Check your balance at least once per day. If you choose a specific time, such as first thing in the morning when you wake up, you’ll create a long-term habit. It will become second nature to check up on your balance, which will enable you to keep a closer eye on your finances.

Add a Backup Account

Most banks allow you to create a backup account for your checking account. You can use a savings account as long as you have money stashed in it, or you can link a credit card. If you accidentally spend more than the balance, the bank will automatically pull funds from the backup. Some banks charge for each transfer, though, so it should serve as your last resort.

Ask for a Waiver

If you accidentally slip up, don’t panic. Just about everyone experiences an overdraft fee at least once in his or her lifetime, so you don’t have to beat yourself up. If this is your first overdraft instance this year, call or visit your bank. Many institutions will waive single overdraft fees as a courtesy to keep customers happy.

You might also have an opportunity to negotiate for lower fees if you have several in a row. For instance, the bank might drop $10 or $20 off what you owe to make the hit more manageable.

Pay Fees Fast

Don’t let a negative balance chew away at your bank account. The financial institution will add new fees each week or so, which means you’ll continue to bleed money. Instead, pay off the fees right away, then use some of the tips above to manage your money more carefully. If all else fails, ask your bank to eliminate overdraft protection for your account. That way, if you try to spend more than you have, the bank will simply decline the charge.

Overdraft fees often plague college students who don’t always know how much they have in the bank. Recognizing the issue and taking steps to resolve it will help you create positive financial habits.

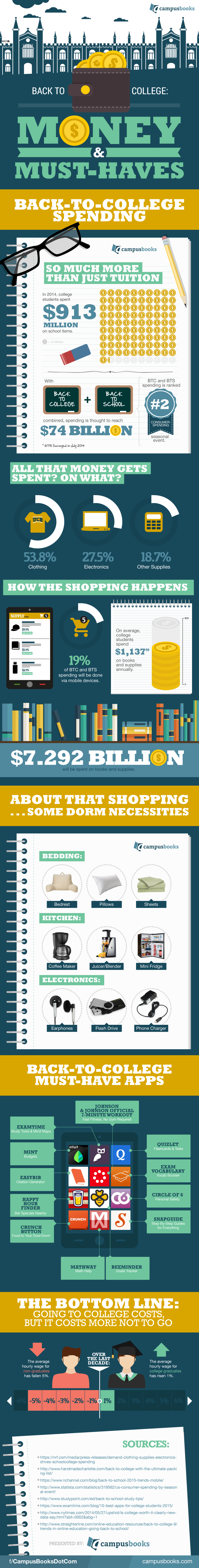

Back to School: Money & Must-Haves

Back-to-school fall rush is a huge time for retailers. In fact, the August back-to-school period is second only to the winter-holiday window (Thanksgiving-Christmas) in terms of seasonal spending. Here’s some perspective on the money matters and must-haves (including apps) for heading to college in 2015. You’ll be astonished by how much money is spent on goods beyond tuition, room and board, and textbooks. And don’t forget those downloads, they can help you with your courses, your wellness, and minding your money of course.

Top-5 Ways to Save Money This Summer

Summer is coming. What are your plans for the next few months until you head back to school? While you certainly want to relax and forget about the stresses of college studies, you may also want to devote some time to financial management and saving money. Tuition isn’t cheap and the money decisions you make during your undergraduate years can shape your post-college financial future (just ask anyone with student loans or someone who was convinced that a free t-shirt was a good reason to take on a high-interest credit card). Take a few minutes and check out our tips for saving and generating some cash this summer.

- Invest in a Short-Term CD: If you have any sort of a nest egg that you won’t need over the summer months, consider investing it in a short-term CD. The interest rate you receive won’t make you rich but it will be more than what you’d get leaving your money in a checking account account and you won’t be tempted to withdraw it for debit-card purchases. Starter CDs require just a small amount of money for a small amount of time so if you have a few hundred dollars or more and you won’t need it for six months or so, bank it in a CD for more interest. Remember that the more you invest at first and for the longer the duration, the more interest you’ll earn, but the penalties for early withdrawal can be substantial so don’t over-commit. Check rates online at NerdWallet or Bankrate.

- Relax in General and Relax on Entertainment Expenses: College can be stressful so it’s expected that you unwind and let off steam. But given that this is college we’re talking about, nothing is done on a small scale. Big exams and big papers tend to mean big parties immediately following. Take time this summer to enjoy things being a little less intense all around. Without the stress of hardcore studies and exams and deadlines, you can chill on smaller, cheaper scale. Instead of hosting that costly mega-bash or bar-hopping, get together with friends and family for things like game night, day hiking, walking dogs, catching up while doing some deck sitting, and movie marathons when summer storms hit.

- Work: Take a part-time summer job or an internship. In addition to earning some money, you’ll meet new people, make valuable connections, gain experience, figure out what you like doing and are good at, and come to appreciate your free time a lot more. If you’re serious about your direction already, get the scoop on summer internships (it’s not too late!) If you’re still finding yourself, enjoy working without the pressure of making it into a career and be open to doing stuff like waiting tables (you’ll make amazing friends and eat cheap) or do landscaping (you’ll get a tan and be ripped). If you’re on the less-active side of things, turn Web time into paid time and do surveys for a company like Pinecone Research.

- Pay Off Credit Card Debt: Every dollar you pay down on your balances is one less dollar you have to pay interest charges on moving forward. Take a look at your balances and use any money you earn over the summer to bring down your debts. Credit-card debt is a killer whether you’re in school or not, and the sooner you get it paid off, the more money you can save. Remember that you don’t have to pay it all at once, just chip away at it by every month paying off more than you spend.

- Take Advantage of the Time at Home: If you’re currently living off-campus, do not make the mistake of remaining in that housing over summer break if you’re paying monthly rent. Move out or sublet the place and go home for the summer where the cost of living is much less. Even though living back under your parents’ roof can be a pain, you can save big time on expenses. If mom and dad are the generous type, you’re likely to enjoy free food and laundry services while you save on several months’ rent. Just be cool about it and show your appreciation. Help out around the house, hug your folks, and give thanks for how good it is to come home and find support and love.

If you hadn’t already noticed, the cost of college is astounding. Even if you’ve never been a planner, it’s important to understand that the average college student now graduates with a stunning $27,000 in student loan debt. Kick back all you want over the summer, just keep costs in mind. For every dollar you don’t spend this summer, that’s one more dollar you can put toward your loan balances.

Guest post courtesy of MoneyCrashers.com‘s Josh Hall, a personal-finance writer who discusses college costs, money management, and smart budgeting tips.

Money Matters: A Special Edition on Textbooks & Tax Credits

At CampusBooks.com, we don’t sell or buy textbooks; our business is that of providing the information and resources that students can use to make the best choices possible when it comes to saving money in their pursuits of higher education. We believe that students have options and that presented with all available information, they will make choices that are personally and globally responsible and savvy.

In this installment of the blog, we’re taking time out to make sure that you’re up to speed on the important and beneficial changes to the Hope and Lifetime Learning Credits portion of the 2009 and 2010 tax code. This information could mean up to $2,500 in tax credits for college students and their families. We urge you to do a few easy things to make sure that you are not only saving the most money now but getting the most money back come tax time.

- Visit TextbookAid.org to find out the full details of the American Opportunity Tax Credit. If your parents or anyone else is involved in paying for your education, share this information with them (and anyone else who could claim you as a dependent come tax time).

- Understand that textbook purchases now qualify as expenses under the program, but to get credit for them, you must save your receipts and keep a record of your qualified spending. The IRS has expanded the definition of qualified spending to include “expenditures for ‘course materials.’ For this purpose, the term ‘course materials’ means books, supplies, and equipment needed for a course of study whether or not the materials are purchased from the educational institution as a condition of enrollment or attendance.”

- If you haven’t already started buying your books, do so now (and file your receipts in an organized fashion). The sooner you do, the greater your chances of getting cheaper used books and first dibs on rentals. Yes, a credit come tax time is great, but savings now is imperative.

The tax-code changes are great news and we hope that you and your families will take advantage of this wonderful way in which the government is alleviating some of the high costs of furthering one’s education.

–Lena

Keeping In Touch Saves You Money

In the midst of summer (but mindful of the new fall term quickly approaching), the last thing we want is for anyone to be tethered to a computer and spending more time on indoor errands than outside enjoying the sun and friends and family. To help you get the info you need and keep you on the go and free to enjoy the weather and the good times, we’ve cranked out some technology to help you get real-time textbook price quotes on the fly.

In addition to our regular site-based search right here at CampusBooks.com, we’ve rolled out an iGoogle Gadget and Real-Time Price Tweetbacks. Check ’em out, load ’em up, and get acquainted so that you can get real-time price quotes without being shackled to a desk. And remember that the earlier you get your ISBN information and order your books, the more cash you’ll save and the more eco-friendly used books you’ll get. That said, make your price checks and orders quick, easy, and mobile by adding these two convenient apps:

For your laptop or smartphone with browser, add the CampusBooks.com iGoogle Gadget. Cool, now you’re always just a click away from the latest info on the best textbook deals.

For Tweeps who prefer information via text/SMS (standard carrier rates apply), you can set up Price Tweetbacks in a few easy steps:

- Follow CampusBooks on Twitter and send a text message to Twitter at 40404 w/the following: “Follow CampusBooks” (a one-time setup).

- Once confirmed and activated, send CampusBooks a direct message via the Web or text Twitter (40404) with the following: “D CampusBooks ISBN” (both ISBN-10 and ISBN-13 are supported).

- CampusBooks.com will respond with the lowest price and a link to purchase the book then and there.

–Lena