Do you remember visiting your local library as a kid? Or maybe the touring book fair that came to your elementary school library? As children, most of us got a lot of joy from reading and excitement in finding the next great book.

In college, some of your passion might subside because you’re reading denser, required material. You’re likely reading books for your literature classes, articles for your history classes, and journals for your science classes. This type of reading can be a drag.

But, it’s possible to bring that delight for reading and love for the public library back. Public libraries are still free and lending out books. It’s time to get a card to find better prices on schoolbooks and rediscover the joy of reading for fun.

Entertainment

Your local library isn’t just about paper books anymore. Most public libraries have joined the technological age and offer e-books and audiobooks that are free to rent. The best part? You don’t even have to go to the physical library to check them out. You can do so online!

This could be great for your fiction reading but also for your required college reading. You might be surprised just what books your local library has in stock.

Price Shopping

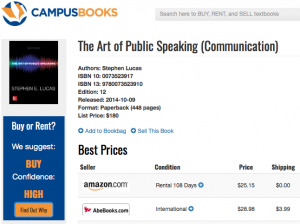

When you’re looking to buy textbooks, you want the best deal. CampusBooks has designed a way to help you out with that. When you use the price comparison tool on our website, you can compare the price of textbooks rented from your local public library with the best prices out there. Can you imagine the money you’d save by renting your textbooks for free from the local library?

We want to make sure that you get the best deal on textbooks. College is expensive enough, so you don’t want to spend more money than you have to.

Services Other Than Books

College is an adventure in learning “how to adult” for the first time. Part of becoming an adult means that there are tasks and errands you’ll need to take care of that you may not know how to.

Surprisingly, your public library might be just the resource you need. After all, it’s not just a repository for old, musty books. The local public library in your college town might also offer services such as notary, help with research, passport applications (taking a summer break trip out of the country?), information for filing taxes, resume evaluation, and help with technology or computers. The librarians will also be able to help you find these resources in the broader community if they aren’t offered by the library.

Archives Research

College students do a lot of research, especially when writing a thesis or capstone. You might find yourself in need of (gasp!) resources for your research that aren’t available online. Public libraries often have extensive hard-copy archives that contain everything from newspaper clippings to building plans to oral histories. You won’t know what’s there in the archives until you ask.

We hope that we revitalized your interest and desire to have a public library card. The public library is a wonderful resource for books to read for fun and for discounted or even free textbooks for college classes.

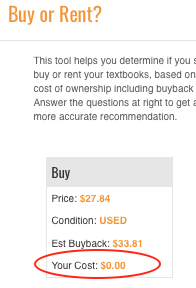

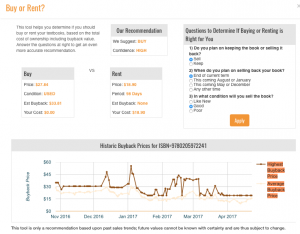

What’s total cost of ownership? That’s what it costs you to get the book and use it, whether that’s buying it and selling it back or renting it and returning it. Sometimes it’s cheaper to rent, sometimes it’s cheaper to buy and sell back, and now you can know and make smart money decisions rather than guess and take a costly hit.

What’s total cost of ownership? That’s what it costs you to get the book and use it, whether that’s buying it and selling it back or renting it and returning it. Sometimes it’s cheaper to rent, sometimes it’s cheaper to buy and sell back, and now you can know and make smart money decisions rather than guess and take a costly hit.