With summer well underway, you might not want to think about hitting the books again in the fall. However, if you take the right steps now, you could prepare yourself for peak productivity when you return to class. It’s easy to daydream about staying organized, planning for the future, and meeting all of your obligations, but none of those dreams will come to fruition unless you start strategizing.

Create Good Habits — and Stick to Them

When you want to create new habits, don’t postpone them until the first day of school. Instead, use the summer to hone your productivity skills, whether you’re working a part-time job, starting a new hobby, or leaning a foreign language. Set achievable goals for yourself, and celebrate each time you hit a milestone.

You might think that some people are just born with a natural ability to organize and stay productive, but you can learn those skills. As you practice, it will become second nature. If you struggle at first, keep a journal to help hold yourself accountable to your failures and your successes.

Leverage Smartphone Apps

That little device that never leaves the palm of your hand can do more than keep you connected to your college pals. Numerous productivity apps exist, so download and test a few on your smartphone. Use these apps to track your to-do list, keep up with your assignments, and manage your calendar.

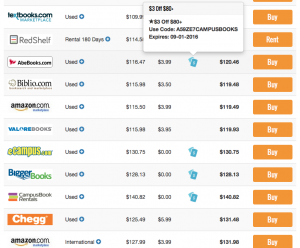

Some students find that their productivity slips when they stress out. Fortunately, apps can also help you balance your budget and save money. For instance, you can use the CampusBooks app to find the best prices on textbooks in the fall.

Establish Boundaries

Unfortunately, most students don’t leave peer pressure behind when they walk across the stage at high school graduation and head to the hallowed halls of their chosen universities. When your friends want to stay up all night and party, you might find yourself tempted to join them.

To combat this pressure, set boundaries for yourself this summer. For instance, maybe you’ll reserve Saturdays and Sundays for recreation and socialization, but keep your weekday nights free for studying. If you’re clear about your boundaries, you can enforce them more effectively.

Go Analog

For some people, technology doesn’t enhance technology — it gets in the way. When using your smartphone or computer for its apps tempts you into conducting endless internet searches or checking your friends’ social media statuses, consider investing in a paper planner. If you’re on a budget, pick up a 50-cent notebook at the supermarket and turn it into a bullet journal.

Along those same lines, set limits for yourself when it comes to technology and media. For instance, you could check social media only once per day and turn off your phone’s text and email alerts.

Productivity isn’t an inborn talent that you can leverage from birth. Some people struggle for it, but you’ll thank yourself when you get your assignments turned in on time and never miss class because of poor planning. If you get in the habit this summer, you’ll nail productivity in the fall.

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using our app) and you’ll see exactly how much more you can save with textbook coupons.

See it? Sweet. Now mouse over that icon (or see the details below the listing if you’re using our app) and you’ll see exactly how much more you can save with textbook coupons.